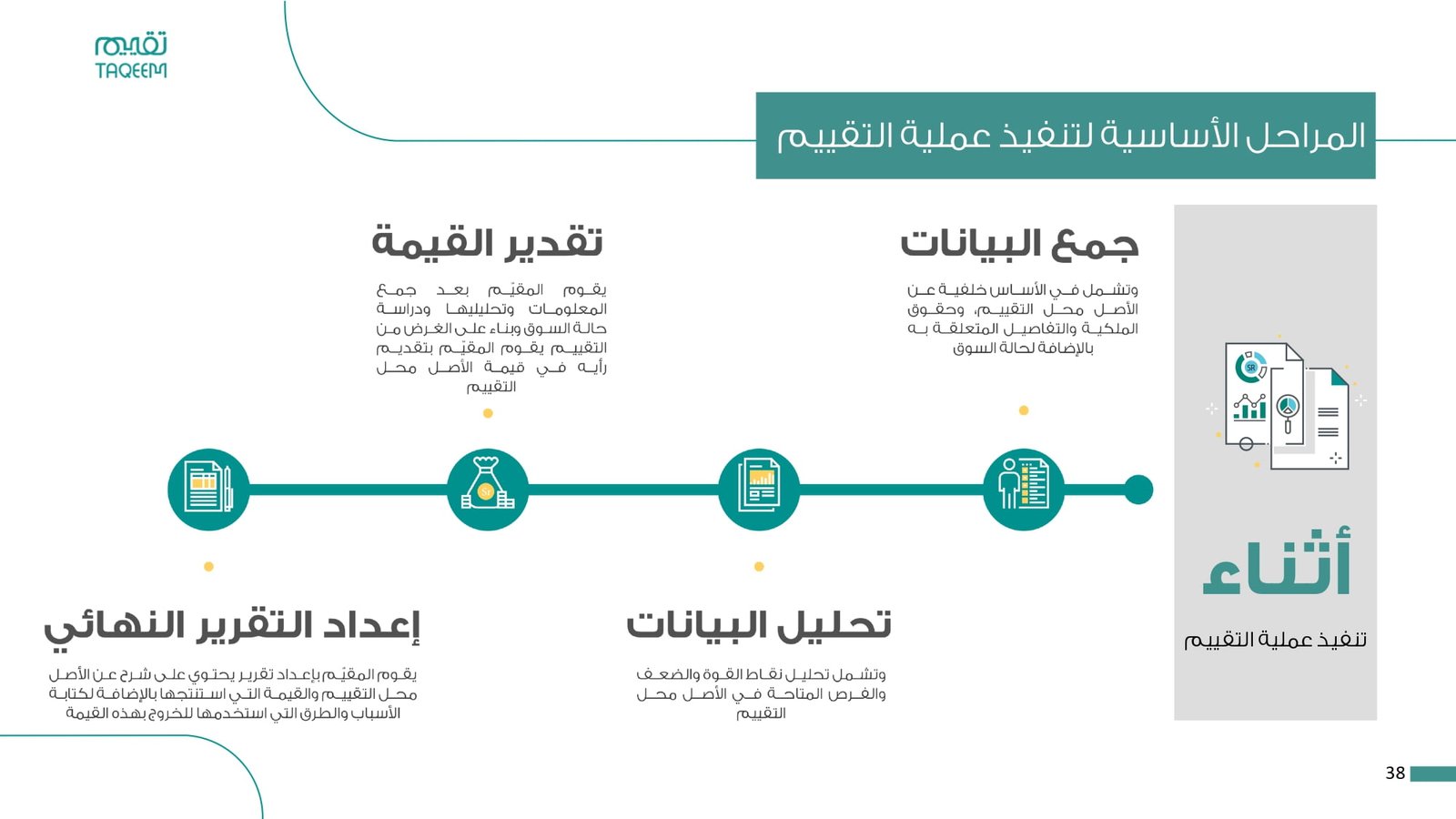

- The first stage: Collecting information:

- This information includes information about the property itself. such as its type, size, location, and characteristics.

- It also includes information about the real estate market in the region. such as prices of similar properties and market trends.

- Second stage: Choosing the right technique:

- There are three main approaches to real estate valuation: Market method, income method, and cost method.

- The most appropriate method depends on the purpose of the assessment, the type of property, and the availability of data.

- Third stage: Apply the method:

- This includes collecting the necessary data, analyzing it, and applying it to the chosen method.

- Fourth stage: Preparation of the report:

- This includes summarizing the results of the evaluation and presenting them in a written report.

Factors to consider during the real estate appraisal process:

- The purpose of the appraisal: Are you selling or buying the property? Do you need funding? Are you using it for tax purposes?

- Type of property: Is it land or building? Is it residential, commercial or industrial?

- Availability of data: Is there enough data available on similar properties in the area?

- Economic conditions: Economic conditions can affect such as inflation and interest. on the value of the property.

The importance of real estate valuation:

- A real estate appraisal helps to accurately determine the value of a property. This enables both sides to negotiate a fair deal.

- In some cases, the law or regulations may require a real estate appraisal. Like getting a mortgage.

- A real estate appraisal can help determine the value of a property for tax or insurance purposes.